Climate finance debate being present in the centre stage of global negotiations for decades only deepens its importance as a global issue.

The contribution of countries to climate change, and their capacity to prevent and cope with its consequences, varies enormously. The convention and the Protocol therefore foresee financial assistance from Parties with more resources to those less endowed and more vulnerable. Developed country Parties shall provide financial resources to assist developing financial country Parties in implementing the Convention. To facilitate this, the Convention established a Financial Mechanism to provide funds to developing country Parties.

In the context of meaningful actions and transparency on implementation, developed countries commit to a goal of mobilizing jointly USD 100 billion dollars a year 2020 to address the needs of developing countries. This funding will come from a wider variety of sources, public and private, bilateral and multitalented, including alternative sources of finance.

Revamp Rave Network held the tenth session of the Second Virtual cohort Programme training on climate change themed “Climate Finances and Negotiation” on the 6th of August 2022. The session was taught Olugbolahan Mark-George- Climate Finance Adviser FGN — NDC Partnership and Ayodele Oluwaropo- Climate Finance Advisor and Associate Investor at Onewattsolar Limited.

Olugbolahan Mark-George in explaining the topic during his session mentioned that the likely scale of resources required by developing countries is perhaps around four times that which developed countries are aiming to provide and the implications of this could be there is (and will be) competition for scarce international climate finance resources and International resources will need to be complemented by domestic resources.

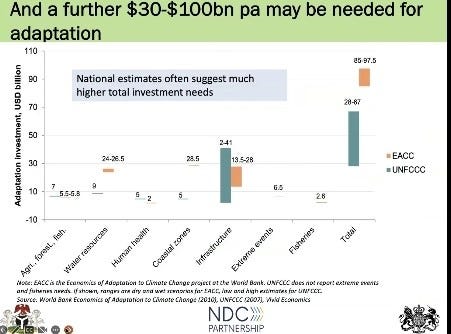

The estimated investments needs in developing countries for mitigation are $180-$450bn pa for mitigation — investment flow is to grim an economy and make it toward a net zero while NDC are very specific and limited sectors to only seven sectors not across the enter economy.

$30-$100bn pa may be needed for Adaptation

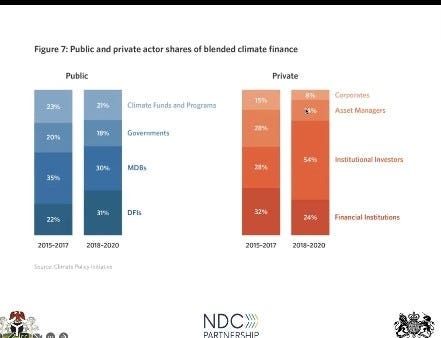

Public and private actor shares of blended climate finance

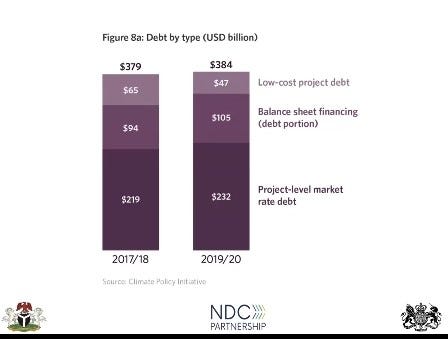

Debt by type (USD billion)

He said funding has been approved for a number of projects in Nigeria which includes Bus-based mass transport support for Abuja, Kano and Lagos; financial intermediation for clean energy and energy efficiency projects; Utility scale solar PV and Nigeria Erosion and Watershed Management Project(NEWMAP). It will be good to note that Climate funds present the best immediate opportunity in Nigeria.

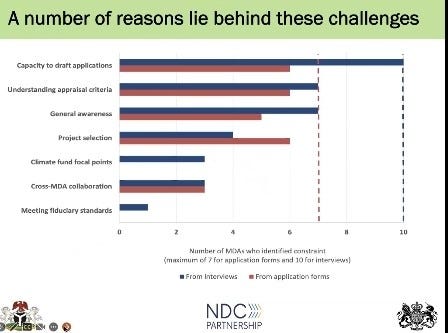

The dedicated climate funds typically allocate funding to projects via a transparent allocation process. The process includes the recipient countries submitting project proposals to the fund which demonstrate how the project contributes to achieving the fund’s strategic objectives, the fund review team reviews each proposal and those that score the highest in a given round are approved for finance. Nevertheless, they are expected to grow significantly over time.

Seven priority funds have been identified in Nigeria based on Country eligibility, Size of eligible projects, Application procedure, Project appraisal criteria, Speed of approval, Financial instrument and Strategic objective and the most amenable to Nigeria includes Adaptation Fund, NAMA facility, Green climate Fund, International climate initiative, Global Environment Facility.

Further, there are five factors that influences the quality of climate finance flows which, Olugbolahan said — Are the interventions consistent with overall development objectives? Are specific selected interventions impactful and cost effective? Are implementation procedures robust so that projects will be delivered on budget and to budget? Is the broader enabling environment supportive? And Will monitoring, reporting and evaluation procedures allow or lessons to be learnt? If these questions are answered then finance will meet project implementation.

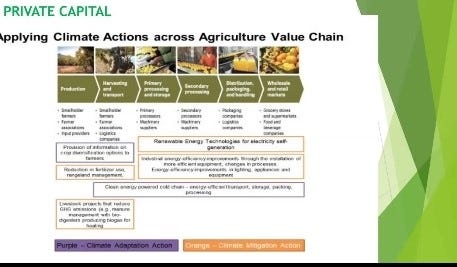

The mainstream of climate actions in wastewater and waste treatment and recycling supply chain, for Adaptation in buildings and construction flood control technologies, installation of domestic wastewater harvesting equipment and water storage, for Mitigation runoffs of existing buildings, architectural or building changes that enable reduced energy consumption will not only help access more climate finance but will be useful to help solve climate crisis, Ayodele Oluwaropo said.

He concluded by saying there is funding available for start-ups and NGOs that are in line with the SDGs and climate change goals and everyone should play their role in climate finance.